News

Newsletter: 4th Quarter, 2018

- November 19, 2018

- By Shannon Dermody

- 0 Comment

Newsletter, 4th Quarter 2018

Employee Spotlight: Paul Foster

Paul has always had an affinity for athletics and developing athletes. As a father, he actively encourages his children to try out new sports from baseball and gymnastics, to his favorite sport basketball.

His connection to the court developed at a young age, playing basketball in Mt. Olive, North Carolina. Paul moved up the ranks and was a member of the 1998-2002 Furman University Basketball Team playing as their point guard. Receiving a basketball scholarship to attend, Paul feels the greatest lesson he learned was how to show up with a positive attitude regardless of the outcome.

Remaining engaged with Paladin Basketball by assisting their coaching staff, and players is how he gives to a program that gave him so much. Serving as a mentor to players past and present, he works to develop their character, scholarship, and financial wellness. More recently he has started a group he coined the “Furman Mafia” a group of community members engaged in improving the basketball program run by Head Coach and friend, Bob Richey. As basketball season continues, look no further than Timmons Arena to see Paul cheering on his purple and white.

Paul Foster is a Principal at Foster Victor Wealth Advisors. He holds his CLU®, CFP®, and CPWA® licenses.

Planner Tip of the Quarter: Treat Saving Like a Bill

By: Rob Victor, CFP®

Most people need accountability when it comes to savings. A free and simple way to create your own accountability is to set up a recurring ACH from your checking account into some type of investment account or savings account. You want to treat your savings like a bill. Most people do two things every single month for a long period of time: they save into their work retirement plan (because it is taken directly out of their pay check) and they pay their mortgage/rent on time (because they will be kicked out of their home otherwise). All we want to do is create another systematic way for you to save after-tax money on a consistent basis and the ACH is a great way to start. The first 3-6 months you may notice the change, but after that it will just become your new normal.

The Gift of Charitable Life Insurance Policies

by: Sarah Masters

The Holiday Season brings forth a multitude of images, feelings, and traditions, and no tradition is more beloved in my family than watching “The Muppet Christmas Carol” together on Christmas Eve. This may not be the most sophisticated version of the story, but the themes of love and charity are prominent and easily understood. One way you can keep the spirit of charity throughout the year is to give the gift of a charitable life insurance policy. Your favorite charity is the owner and beneficiary of the policy on your life and the premiums you pay receive a charitable deduction for income tax purposes. As Jacob Marley from A Christmas Carol said, “Mankind was my business. The common welfare was my business; charity, mercy, forbearance, benevolence, were all my business.”

Kylie’s Fraud Protection Tip of the Quarter

Hackers are constantly trying to access usernames and passwords to sell on the Dark Web. We recommend changing your email passwords regularly and enabling dual authentication whenever possible.

This is especially crucial if your email domain is Xfinity, Comcast or Yahoo as there has been an increased level of fraud activity using these domains.

Teaching Your Kids About $$$: Lessons Learned From Family

By: Erik Mizell, CLU®, CFP®

The lessons learned as a young boy who was fortunate enough to grow up in a farming family are endless. The dynamic of living in this environment allowed for ample opportunity to absorb “education” from my parents and extended family. Aside from learning how to fix almost everything at a moment’s notice and continuously learn from my mistakes, we often were able to have candid discussions about how to handle the trials of money. There are many stories that I can go back to now as a Dad with kids of my own that provide financial guidance.

Some of my favorite lessons were learned while riding with my Grandfather on a tractor and to picking vegetables from the garden with my extended family. The overwhelming theme was always to be grateful for the things God has blessed you with, and to avoid being wasteful of those blessings. My Grandfather shared with us the experience of banking at a very early age. He would pay us on Friday at lunch for our work that week on the farm, and then we would all pile into the pickup for a trip to the local bank. Once there, we would be tasked with cashing our “paycheck” and depositing a portion into our savings account. Of course, we would stop by the local gas station for a treat before turning back to finish the workweek with our afternoon chores.

I didn’t know it at the time, and I really am not certain it was intentional, but my Grandfather managed to instill in me the foundation of always paying yourself first by saving a portion of every paycheck. This foundational skill has stuck with me as I’ve aged and my paycheck has grown and is something I hope to teach my children too.

Donor Advised Funds, The Smart Way To Give

by: Elizabeth Reynolds

This time of year, the reminder to give is all around. From meals shared with coworkers, friends, and family to the bell ringers outside our local stores we are constantly given the opportunity to share with others. Keeping in mind changes that occurred with the Tax Cuts and Jobs Act of 2017 you can make your giving smarter by using a Donor Advised Fund (DAF). Prior to this Act, charitable donations were an easy tax write off. With the new changes to tax law only those amounts that exceed the standard deduction (Single $12,000, Married $24,000) can be written off. A Donor Advised Funds is a charitable investment vehicle that allows you to take a one time tax deduction. For example, a couple could choose to put a lump sum of $40,000 in a donor advised fund and take a one-time deduction of $16,000 (Standard Deduction – DAF contribution = Tax Deduction). The beauty of these funds is that you can take a one time tax deduction but use the fund to accomplish your giving over the following several years while your assets grow. This could be an especially advantageous decision in a year when you anticipate paying higher taxes. To learn more about Donor Advised Funds contact your Foster Victor Advisor.

Reading Suggestions:

Every quarter we select articles that you may find educational and informative.

- New Homebuyers Face A Friendlier Market, Thanks to Cooldown

- Ford Gets Into The Scooter Business, Joins Bird And Lime

- Five Critical Settings So Hackers Can’t Access Your Bank Account

Be Willing To Be Critical

By: Peter Nielsen, MBA, CFA®

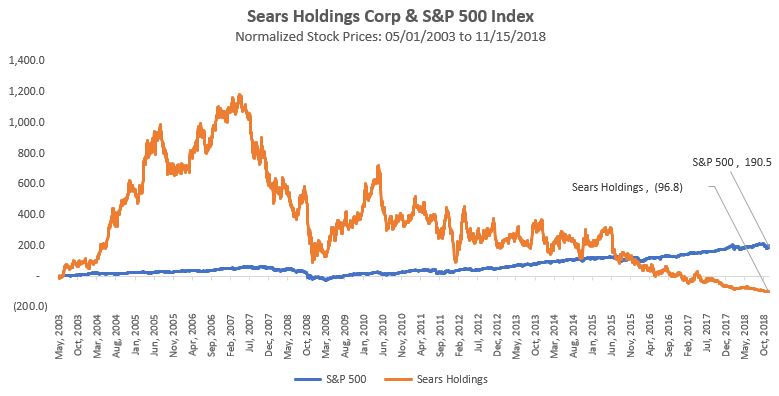

Sears Holdings (SHLD) filed for bankruptcy protection in October. What makes this so interesting is that Sears dominated the retail landscape for decades just as Amazon does now. The company was started in 1888 when Richard Sears mailed out his first catalog. It was considered revolutionary at a time when most Americans were dependent on local stores to buy their goods. It presented consumers with greater choices at better prices. 37 years later, Sears opened their first department store, and many followed soon after. In a similar vein, when Amazon.com launched in 1994, it offered consumers greater choice and better prices. Initially, Amazon only sold books. Now you can buy almost anything through their website. In 2015 they opened their first store and continued to expand their retail presence through the purchase of Whole Foods. See the parallel?

The warning for investors is not to be complacent. One investment saying we’re fond of is “there are no one-decision stocks.” Sticking with a name without critically evaluating it can really hurt you. Sears joins the likes of Eastman Kodak, Blockbuster Video, Pan American Airlines, etc. in the pantheon of the once great. It’s hard to imagine blue-chip companies hitting hard times, but almost all of them hit a rough patch at some point.

Unfortunately, some investors fail to critique their portfolios and follow the results of the companies in which they own stock. That’s part of the value professional managers bring to clients. Portfolios require an ongoing critical assessment of the opportunities and risks associated with each individual asset.

Quarterly Fund Suggestion:

DWS Managed Municipal Bond

Ticker = SCMBX

Reasons we like it:

- This fund is held in our models for taxable accounts. It is a municipal bond fund, so the annual interest is more tax efficient than a corporate bond fund.

- The Morningstar Analyst Rating is Bronze.

- The two lead managers, Ashton Goodfield and Matthew Caggiano, have been managing this fund since 1998 and 1999 respectively.

- Current yield is 3.4%. This is slightly higher than the average of other funds in their peer group, which is 3.2%.

To see more about what FVWA is doing in the community, check out our Instagram!

- Post Categories

- Newsletters

Shannon DermodyTEST